Personal Tax

Due Day Extended for Personal Tax Submission: 15 May 2013 (E-Filing Only)

Inland Revenue Board (LHDN, Lembaga Hasil Dalam Negeri) has extended the deadline for personal tax return submission and balance of tax payment for employment income to 15 May 2013.

The extension of due date is...

Personal Income Tax Relief for YA 2011 (submit your tax return before 30 April...

Personal tax relief is available for those who have stayed in Malaysia for more than 182 days, regardless of the nationality of that individual.

All individual who do not have any business income in the year of...

Increasing Tax Audits by IRB Malaysia

Following the implementation of Self Assessment Taxation System in Malaysia years ago, the Inland Revenue Board switches its focus and attention in doing tax audits to ensure taxpayers comply with the legal provisions and...

Housing loan interest tax deduction of RM10,000 per year for 3 years of assessment

Claim your housing loan interest as personal tax deduction/relief up to RM10,000 per year for 3 years of assessment (RM10,000 x 3 YAs = RM30,000 in total), if you buy a house before 31...

If you claim tax reliefs, make sure you keep all the receipts (for 7...

Every tax payers are allowed to claim tax reliefs to set-off against their employment or business income when calculating their personal tax.

However, based on our experience, most of the tax payers have easily believed...

Employee Benefits and Income earned by Staff exempted from Income Tax

With effect from YA 2008, employees are given tax exemption on allowances, benefits in kind and perquisites that received from their employer as follows:

(a) perquisites in relation to travel allowance, petrol card, petrol allowance...

Malaysia Personal Income Tax Rates 2013

Calculate your personal income tax payable 2013 from the following table: Malaysian Personal Income Tax Rates 2013.

All personal income tax submission for year of assessment 2013 via e-filing must be done on or before...

Malaysia Personal Income Tax Rates & Table 2010

Every individual is subject to tax on income earned in Malaysia or received in Malaysia from outside Malaysia. Income earned in oversea remitted to Malaysia by a resident individual is exempted from tax.

A non-resident...

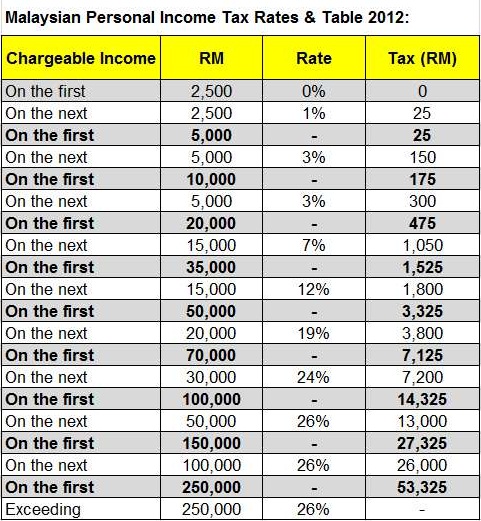

Malaysia Personal Income Tax Rates & Table 2012

Every individual is subject to tax on income earned in Malaysia or received in Malaysia from outside Malaysia. Income earned in oversea remitted to Malaysia by a resident individual is exempted from tax.

The following...

Malaysia individual tax deduction – Broadband subscription fee for YA2010 to YA2012

Malaysia Inland Revenue Board (IRB) on 12 April 2011 issued a Technical Guideline on personal tax relief or deduction on the broadband subscription fee. It clarifies that individual (employee) who receives benefit on using...