Following the implementation of Self Assessment Taxation System in Malaysia years ago, the Inland Revenue Board switches its focus and attention in doing tax audits to ensure taxpayers comply with the legal provisions and the current tax regulations.

Following the implementation of Self Assessment Taxation System in Malaysia years ago, the Inland Revenue Board switches its focus and attention in doing tax audits to ensure taxpayers comply with the legal provisions and the current tax regulations.

Tax audits are conducted through field audits and desk audits.

TAX AUDITS

|

2005 |

2006 |

2007 |

2008 |

2009 |

|

|

Number of cases resolved |

7,204 |

6,741 |

279,175 |

1,052,939 |

1,399,660 |

|

Taxes and Penalties (RM’Mil) |

635.40 |

692.68 |

1,410.57 |

1,697.16 |

3,054.95 |

Field audits – A notice informing of a visit to the taxpayer’s business premises and the information/documents that have to be prepared is issued prior to field audit. (In 2009, 7,942 resolved cases or 0.6% of total resolved cases conducted via field audits)

Desk audits – On the other hand, desk audit is conducted at IRBM’s office based on the information submitted. (In 2009, 1,391,718 resolved cases or 99.4% of total resolved cases conducted via desk audits)

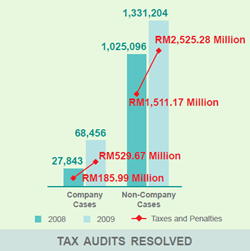

From the diagram on the left, interesting to see that those tax audits resolved mainly arising from non-company cases (1.3 million cases in 2009) compared to company cases (only 68k cases in 2009).

Tax revenue contribution from companies in 2009 made up 46% of total tax revenue and individual tax revenue only made up of 18% in 2009. But when come to tax audits, it is the other way round. More tax audits cases on non-companies and recovered higher taxes. Are we saying more tax omissions or even evasions on the personal tax? Perhaps.

(Source: THE INLAND REVENUE BOARD OF MALAYSIA – ANNUAL REPORT 2009)