Personal Tax

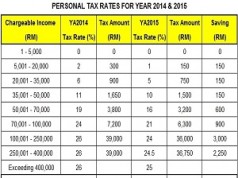

Budget 2015: New Personal Tax Rates for Individuals (YA2015)

As it was announced in Budget 2014 & proposed in the latest Budget 2015, individuals income tax rates will be reduced by 1% to 3% with...

Due Day Extended for Personal Tax Submission: 15 May 2013 (E-Filing Only)

Inland Revenue Board (LHDN, Lembaga Hasil Dalam Negeri) has extended the deadline for personal tax return submission and balance of tax payment for employment...

Pay Your Tax Now or You Will Be Barred From Travelling Oversea

You will be barred from leaving the country if you have yet to settle your income tax or property tax (RPGT) from October 2013...

Get your tax refund within 30 days if you use e-Filing

TAXPAYERS using e-Filing will be getting their refund credited directly into their bank accounts within 30 days after the declaration is made.

Inland Revenue Board...

Claim your expenses to reduce employment income and personal tax

If you are receiving travelling or entertainment allowances from your company, you don't need to report it to income tax department (LHDN)!

You can claim...

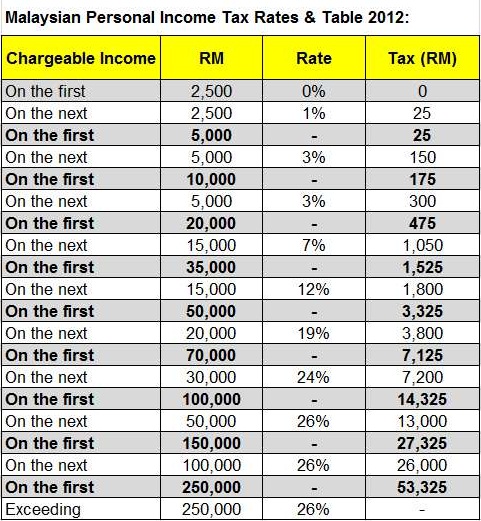

Malaysian Personal Income Tax Rates & Table 2009

Every individual is subject to tax on income earned in Malaysia or received in Malaysia from outside Malaysia. Income earned in oversea remitted to...

Do I still need to pay tax if I am paying PCB every month?

A lot of people get confused when they thought that the income tax has already been taken care of by the deduction of PCB...

FAQ: RM6,000 tax relief for children education savings

The National Education Savings Scheme (SSPN-i ) was designed by the National Higher Education Fund Corporation (PTPTN) for the purpose of higher education.

As announced...

Housing loan interest tax deduction of RM10,000 per year for 3 years of assessment

Claim your housing loan interest as personal tax deduction/relief up to RM10,000 per year for 3 years of assessment (RM10,000 x 3 YAs =...

Employee Benefits and Income earned by Staff exempted from Income Tax

With effect from YA 2008, employees are given tax exemption on allowances, benefits in kind and perquisites that received from their employer as follows:

(a)...