Personal Tax

Claim your expenses to reduce employment income and personal tax

If you are receiving travelling or entertainment allowances from your company, you don't need to report it to income tax department (LHDN)!

You can claim your expenses to set-off against the employment income received from...

Annual tax filing deadline by businessmen due today

30 June 2011 marks the last day of first half year of 2011. Time flies, we are mid way through year 2011.

For businessmen carried out their businesses under sole proprietorship and partnership, they all...

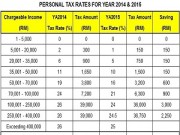

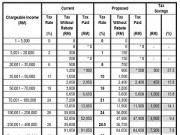

Malaysia Personal Income Tax Rates & Table 2011

Click here for Malaysia Personal Income Tax Rates & Table 2012

Every individual is subject to tax on income earned in Malaysia or received in Malaysia from outside Malaysia. Income earned in oversea remitted to...

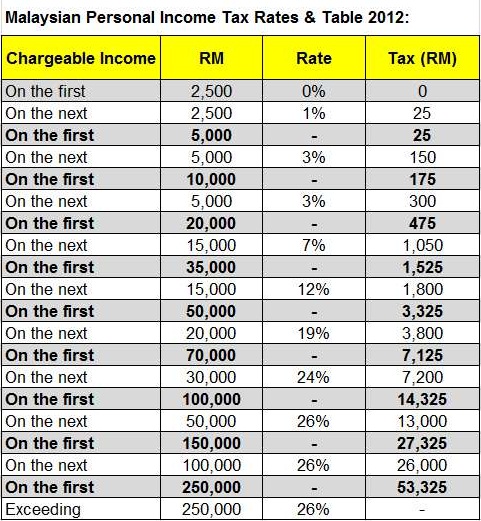

Malaysia Personal Income Tax Rates & Table 2012

Every individual is subject to tax on income earned in Malaysia or received in Malaysia from outside Malaysia. Income earned in oversea remitted to Malaysia by a resident individual is exempted from tax.

The following...

Malaysia Direct Tax Revenue Collections for 2009

Company taxpayers are still the biggest contributor to the government’s revenue of RM40.27 billion, representing 45.55% of the total revenue collection. Followed by petroleum income tax and individual income tax which contribute to 30.80%...

Malaysia Personal Tax – FAQ

Encountered some questions on Malaysia personal tax matters?

Inland Revenue Board (IRB), the Malaysian tax authorities published some FAQ that may be relevant to individual tax payer in Malaysia. Here are some extracts:

Assessment of Tax

Q...

Get your tax refund within 30 days if you use e-Filing

TAXPAYERS using e-Filing will be getting their refund credited directly into their bank accounts within 30 days after the declaration is made.

Inland Revenue Board (IRB) public relations officer Masrun Maslim said the refund would...

Submit your Form B 2010 tax return by 30 June 2010

In a press release, Inland Revenue Board Malaysia will continue its Taxpayer Service Month Program until 30 June 2011.

The program is focus on taxpayers who are deriving business income submitting their Form B for...

IRB issues public ruling: Taxation on foreign workers

On 16 November 2011, Inland Revenue Board Malaysia issued Public Ruling No 8/2011, “Foreign Nationals Working in Malaysia – Tax Treatment”, which explains the tax treatment of employment income derived by foreign nationals exercising...

Due Day Extended for Personal Tax Submission: 15 May 2013 (E-Filing Only)

Inland Revenue Board (LHDN, Lembaga Hasil Dalam Negeri) has extended the deadline for personal tax return submission and balance of tax payment for employment income to 15 May 2013.

The extension of due date is...