With effect from YA 2008, employees are given tax exemption on allowances, benefits in kind and perquisites that received from their employer as follows:

With effect from YA 2008, employees are given tax exemption on allowances, benefits in kind and perquisites that received from their employer as follows:

(a) perquisites in relation to travel allowance, petrol card, petrol allowance or any of its combination for travelling between the home and work place up to RM2,400 per year.

(b) perquisites in relation to travel allowance, petrol card, petrol allowance or toll rate or any of its combination for travelling for official duties up to RM6,000 per year.

(c) parking rate or parking allowance.

(d) meal allowance.

(e) child care allowance of up to RM2,400 a year.

(f) gifts and monthly bills for fixed line telephone, mobile phone, pager, or broadband.

(g) the amount of subsidy on interest of housing, education or car loan shall be determined in accordance with the following formula: A x (B / C)

A – difference between the amount of interest to be borne by the employee and the amount of interest payable by the employee in a basis period for a year of assessment;

B – the total aggregate of balance of the principal amount of the housing, education or car loan taken by the employee in a basis period for a year of assessment or RM300,000.00, whichever is the lower; and

C – the total aggregate of the principal amount of the housing, education or car loan taken by the employee.

(h) medical benefits exempted from tax be extended to include expenses on maternity and traditional medicines.

(i) discounted price for consumable business products of the employer up to RM1,000 per year.

(j) discounted price for services provided by the business of the employer and for the benefit of the employee, spouse and child of the employee.

The above exemptions are not extended to an employee where the employee has control over his employer. All the above proposals are effective from Y/A 2008 except for item (a) which is effective from Y/A 2008 to Y/A 2010.

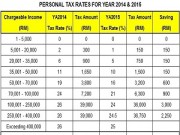

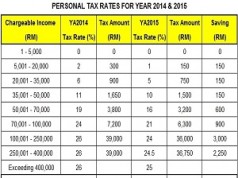

Popular Now: Malaysia Personal Tax Rates (Table) 2011