Goods & Services Tax (GST)

GST: main cause for higher inflation in 2015

Goods and Services Tax (GST) has been very must talk of the town following the announcement of time table for implementing GST in the Budget 2014 by Prime Minister Datuk Seri Najib Razak.

Based on other...

Budget 2014: The introduction of Goods and Services Tax (GST)

It was announced by the government in Budget 2014 that Goods and Services Tax (GST) will be implemented effective from 1 April 2015 and GST rate will be fixed at 6 (%) per cent.

Sales tax and service tax...

Budget 2014: Pay less tax in Goods and Services Tax (GST)?

It was announced by our Prime Minister that 300,000 individuals who are earning a monthly income of RM4,000 will no longer need to pay any income tax in 2015, following the implementation of GST in...

Budget 2014: GST will not be implemented?

Budget 2014 is just around the corner and is to be announced by our prime minister on this Friday, 25 October 2013, since then the Goods & Services Tax (GST) has been much the...

Second Schedule To The Service Tax Regulations 1975

1. The persons mentioned under the heading for Taxable Person in Groups A, B1, B2, C, D, E, El, F, and G of this Schedule providing any taxable service under the heading for...

Service Tax – Indirect Tax in Malaysia

Service tax is a consumption tax levied and charged on any taxable service provided by any taxable person. The Service Tax Act 1975 applies throughout Malaysia excluding Langkawi, Labuan, Tioman and the Joint Development...

Are you paying service charge or service tax?

Service tax collector, the Royal Malaysian Customs Department received many complaints on confusion about Service Charges, Service Tax and Government Tax imposed by some of the businesses/companies and wondering if they are actually the...

Goods and Services Tax (GST) Guides Issued

The Malaysian government continues its efforts in seeking public feedback and acceptance of the Goods and Services Tax (GST) implementation in Malaysia, as well as continues to create public awareness and educate the people and...

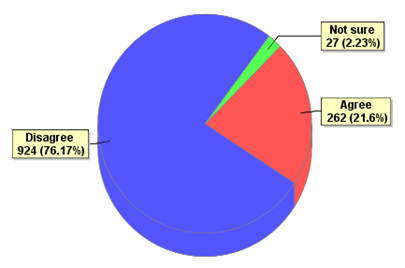

Do you agree that GST should be implemented in Malaysia?

e-Poll - “Do you agree that Goods and Services Tax (GST) should be implemented in Malaysia?”

The e-poll is put up by Royal Malaysian Customs at its official website www.gst.customs.gov.my to gather and understand public...

GST implementation will be postponed

The Finance Ministry announced today that the implementation of Goods and Services Tax (GST) will be postponed. This is to enable the government to engage the public for more feedback and ensure the enforcement...