Personal Tax

Tax Return Form B 2010 and Form P 2010

30 June 2011 tax filing deadline for Tax Return Form B 2010 and Form P in respect of year of assessment 2010 is approaching with less than a month to go.

Form B is tax...

FAQ: RM6,000 tax relief for children education savings

The National Education Savings Scheme (SSPN-i ) was designed by the National Higher Education Fund Corporation (PTPTN) for the purpose of higher education.

As announced in Budget 2013, it is proposed that personal tax relief...

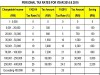

Malaysia Direct Tax Revenue Collections for 2009

Company taxpayers are still the biggest contributor to the government’s revenue of RM40.27 billion, representing 45.55% of the total revenue collection. Followed by petroleum income tax and individual income tax which contribute to 30.80%...

Increasing Tax Audits by IRB Malaysia

Following the implementation of Self Assessment Taxation System in Malaysia years ago, the Inland Revenue Board switches its focus and attention in doing tax audits to ensure taxpayers comply with the legal provisions and...

Annual tax filing deadline by businessmen due today

30 June 2011 marks the last day of first half year of 2011. Time flies, we are mid way through year 2011.

For businessmen carried out their businesses under sole proprietorship and partnership, they all...

IRB issues public ruling: Taxation on foreign workers

On 16 November 2011, Inland Revenue Board Malaysia issued Public Ruling No 8/2011, “Foreign Nationals Working in Malaysia – Tax Treatment”, which explains the tax treatment of employment income derived by foreign nationals exercising...