Goods & Services Tax (GST)

GST: main cause for higher inflation in 2015

Goods and Services Tax (GST) has been very must talk of the town following the announcement of time table for implementing GST in the Budget...

Are you ready for GST in Malaysia?

The Government of Malaysia proposed the Goods and Services Tax (GST) in November 2009 and tabled the Goods and Services Tax Bill 2009 for...

Goods & Services Tax (GST) Is Now Law in Malaysia

Goods & Services Tax (GST) is now Law in Malaysia and to be formally known as "Goods And Services Tax Act 2014".

Malaysian Goods and...

Budget 2014: Pay less tax in Goods and Services Tax (GST)?

It was announced by our Prime Minister that 300,000 individuals who are earning a monthly income of RM4,000 will no longer need to pay any...

What is GST ? Is GST a new consumption tax?

Good & Services Tax (GST) is a consumption tax based on the value-added concept. GST is imposed on goods and services at every production...

Car sales to jump with big savings from zero GST

PETALING JAYA: Car sales are expected to jump in the next two or three months, as the country enjoys a “tax holiday” following the zero...

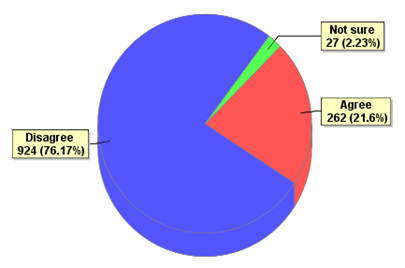

GST: Government Tax on Everything & Everyone

Will Goods & Services Tax (GST) affect everyone? Yes, GST will affect almost EVERYONE in Malaysia, including those staying in the rural area or...

Details and Scope of Goods & Services Tax

The much sought after details and scope of the Goods and Services Tax (GST) have been released by the Custom Department. GST will be...

Budget 2014: The introduction of Goods and Services Tax (GST)

It was announced by the government in Budget 2014 that Goods and Services Tax (GST) will be implemented effective from 1 April 2015 and GST rate will...

Will GST implementation be announced in Budget 2011?

Many have concerned whether the Malaysia Government will announce the implementation of the Goods and Services Tax (GST) in Budget 2011, which has drawn...