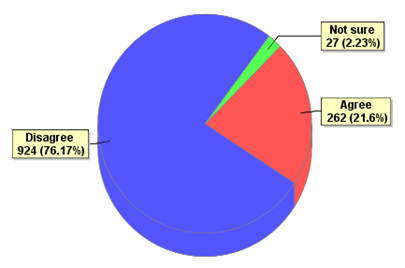

e-Poll – “Do you agree that Goods and Services Tax (GST) should be implemented in Malaysia?”

The e-poll is put up by Royal Malaysian Customs at its official website www.gst.customs.gov.my to gather and understand public feedback on the implementation of GST in Malaysia.

Out of the total votes (1,213), 924 votes or 76% were disagreed with the implementation of GST, while 262 votes or 22% agreed with it. The e-poll results may not be a good representative of public feedback as it is only involved 1,213 votes or people perhaps.

What are the benefits or pros & cons for implementing GST in Malaysia? Among the pros and cons, benefits/advantages or disadvantages of GST perceived by the public are:-

Reasons support for GST:

- Increase national/government revenue and mitigate the heavy reliance on income tax and petroleum tax, in which income taxes contributed 44.4% of government revenue in 2010.

- Tax burden will not increase when income level increased.

- “Everyone” will pay tax and tax burden is spread over, instead of just relying on income taxes derived from 15% of the working population.

- Overcome the loopholes of current sales and services tax systems.

- Eliminate over-lapping tax at different stages, as GST is generally charged on the consumption of goods and services at every stage of the supply chain, with the tax burden ultimately borne by the end consumer.

- More stable for government revenue with GST as a consumption tax based, compared to direct income taxes and minimise the impact of economic cycles, particularly during recessions.

- Corporate tax and individual tax rates could be reduced.

- Minimise the occurrences of tax evasions.

Reasons disagree with GST:

- May result in inflation as general products prices may go up.

- Increase the tax burden on low income working group (the other 85% as described item 3 above)

- The government may possibly increase the GST rate from 4% to 15% to increase revenue.

- Worry that the GST tax may even higher than current sales tax 10% and service tax 5%.

- Worry that the effect of tax revenue re-distribution may not be achieved.

What an brilliant blog, thank you for placing this information.

I’m very new to your weblog,however it seems pretty interesting:-)

I had to refresh the page 2 times to view this page ws sign for some reason, however, the information here was worth the wait.

Great blog here i like all the information thats being shared, congratulations.

This is my first time i pay a visit to here; I discovered so many helpful stuff within your website specifically its discussion! From the a great deal of comments in your articles; I guess Im not the only one receiving the quite a few satisfaction appropriate here! maintain up an excellent job!

may i know more detail about GST?

Actually GST already implemented in Malaysia now? When it will implement / when it was implemented?

I read newspaper, i am not sure is it all goods (e.g : steel, bricks, water closet, furnitures, tiles and etc) will add-on charges of GST and will increase the cost compare with selling cost before GST implement?

Wish some1 can explain to me a.s.a.p so that i can make myself clear. Thank you very much…

What is the hurry in implementation of GST since we haven’t achive 2020?

i dont agree..unless the personal income tax is reduced to..

maximum bracket of only 20% for those >400k of chargeable income.

those with chargeable income of 250k-400k should be 18%.

for those with chargeable income between 100k-250k should be 15% only.

those 70k-100k should be 10% only.

the rest is reduced accordingly.

i hav wasted a week time.i hav do drive hard from tomorow.no time to waste

I am very disagree this GST system! If GST is implemented, there’s no match with global pricing and this country will end up very soon! Who is paying 6% tax? You, citizen, Think about it!

lets just wait until GST is implemented in our country, then only we can decide whether GST should be established in Malaysia based on the effect the people received.