Goods & Services Tax (GST)

GST implementation will be postponed

The Finance Ministry announced today that the implementation of Goods and Services Tax (GST) will be postponed. This is to enable the government to engage the public for more feedback and ensure the enforcement...

GST: Government Tax on Everything & Everyone

Will Goods & Services Tax (GST) affect everyone? Yes, GST will affect almost EVERYONE in Malaysia, including those staying in the rural area or in the kampung.

Everyone include adults, kids, companies & businesses (sole...

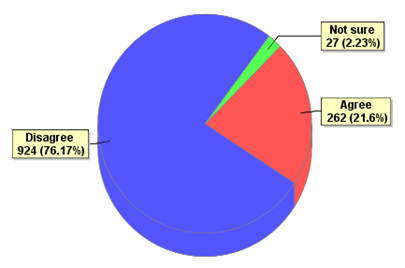

Do you agree that GST should be implemented in Malaysia?

e-Poll - “Do you agree that Goods and Services Tax (GST) should be implemented in Malaysia?”

The e-poll is put up by Royal Malaysian Customs at its official website www.gst.customs.gov.my to gather and understand public...

Second Schedule To The Service Tax Regulations 1975

1. The persons mentioned under the heading for Taxable Person in Groups A, B1, B2, C, D, E, El, F, and G of this Schedule providing any taxable service under the heading for...

Service Tax – Indirect Tax in Malaysia

Service tax is a consumption tax levied and charged on any taxable service provided by any taxable person. The Service Tax Act 1975 applies throughout Malaysia excluding Langkawi, Labuan, Tioman and the Joint Development...

Car sales to jump with big savings from zero GST

PETALING JAYA: Car sales are expected to jump in the next two or three months, as the country enjoys a “tax holiday” following the zero rating of the Goods and Services Tax (GST) from June...

Are you paying service charge or service tax?

Service tax collector, the Royal Malaysian Customs Department received many complaints on confusion about Service Charges, Service Tax and Government Tax imposed by some of the businesses/companies and wondering if they are actually the...

What is GST ? Is GST a new consumption tax?

Good & Services Tax (GST) is a consumption tax based on the value-added concept. GST is imposed on goods and services at every production and distribution stage in the supply chain including importation of...

Malaysia to reveal its position on proposed GST

Dow Jones news reported that the Malaysian government will announce its position on the proposed Goods and Services Tax (GST) late today, two days ahead of the Malaysia Budget 2011 announcement on this Friday.

Are you ready for GST in Malaysia?

The Government of Malaysia proposed the Goods and Services Tax (GST) in November 2009 and tabled the Goods and Services Tax Bill 2009 for first reading in Parliament in December 2009. Second reading was...