Goods & Services Tax (GST)

Are you paying service charge or service tax?

Service tax collector, the Royal Malaysian Customs Department received many complaints on confusion about Service Charges, Service Tax and Government Tax imposed by some...

Details and Scope of Goods & Services Tax

The much sought after details and scope of the Goods and Services Tax (GST) have been released by the Custom Department. GST will be...

Budget 2014: The introduction of Goods and Services Tax (GST)

It was announced by the government in Budget 2014 that Goods and Services Tax (GST) will be implemented effective from 1 April 2015 and GST rate will...

Second Schedule To The Service Tax Regulations 1975

1. The persons mentioned under the heading for Taxable Person in Groups A, B1, B2, C, D, E, El, F, and G of...

Budget 2015: No GST for Books, Noodles, RON95 Petrol, Newspapers & Others

Targeted consumers will not have to pay GST on the purchase of RON95 petrol, diesel and LPG.

The Government has confirmed that the following items will not...

Budget 2014: Pay less tax in Goods and Services Tax (GST)?

It was announced by our Prime Minister that 300,000 individuals who are earning a monthly income of RM4,000 will no longer need to pay any...

Goods and Services Tax (GST) Guides Issued

The Malaysian government continues its efforts in seeking public feedback and acceptance of the Goods and Services Tax (GST) implementation in Malaysia, as well as...

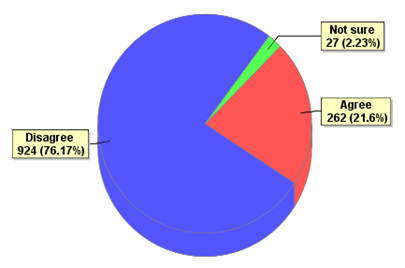

Are you ready for GST in Malaysia?

The Government of Malaysia proposed the Goods and Services Tax (GST) in November 2009 and tabled the Goods and Services Tax Bill 2009 for...

Car sales to jump with big savings from zero GST

PETALING JAYA: Car sales are expected to jump in the next two or three months, as the country enjoys a “tax holiday” following the zero...

GST implementation will be postponed

The Finance Ministry announced today that the implementation of Goods and Services Tax (GST) will be postponed. This is to enable the government to...