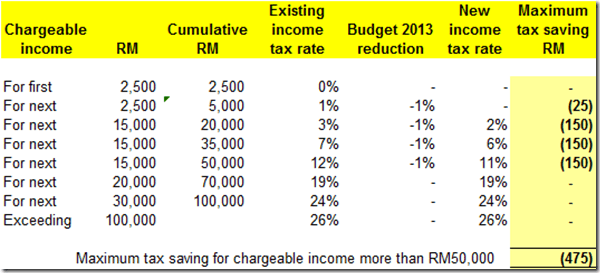

The new individual income tax rates effective from year of assessment 2013 is tabulated below and tax rate reduction gives a maximum tax saving up to RM475 for a person with chargeable income of more than RM50,000.

The Government is concerned about the rising cost of living on the rakyat as well as their income tax liabilities. The Government has provided 20 individual tax reliefs and two tax rebates.

With these tax reliefs and rebates, only 1.7 million persons pay tax compared to the overall workforce of 12 million.

In the transition process from the current tax system, based on income to a tax system that is fairer, the Government proposes that individual income tax rate be reduced by 1 percentage point for each grouped annual income tax exceeding RM2,500 to RM50,000.

The measure will remove 170,000 taxpayers from paying tax as well as provide savings on their tax payment. As an example, unmarried young professional with a monthly income of RM5,000 will enjoy income tax savings up to RM425 per person.

The following table is applicable to those income earned in 2012 and tax submitted to LHDN in 2013: