Hektar Real Estate Investment Trust (REIT) announced its Q3 2010 results yesterday, with some extracts below:

| Cumulative 3 Quarters |

Current |

Preceding |

|

|

|

YTD |

YTD |

|

|

|

30.9.2010 |

30.9.2009 |

% |

| Revenue | |||

| Actual revenue – billing |

66,837,205 |

66,182,580 |

1.0% |

| Revenue under FRS 117 |

1,059,693 |

– |

100% |

| Total revenue |

67,896,898 |

66,182,580 |

2.6% |

| Trade receivables | |||

| – actual billing |

706,621 |

375,188 |

88.3% |

| – receivables under FRS 117 |

1,059,693 |

– |

100% |

| Total trade receivables |

1,766,314 |

375,188 |

370.8% |

| Liabilities | |||

| Deferred income (FRS 139) |

1,058,904 |

– |

|

|

Cash flow from operating activities |

|||

| Adjustment for non-cash item | |||

| – Revenue under FRS 117 |

(1,059,693) |

– |

Accounting policies disclosed in the Quarterly Report (QR):

A13 RENTAL INCOME FROM TENANCIES (FRS 117: Leases)

Rental income receivable under tenancy agreements is recognized on a straight-line basis over the term of the lease. Meanwhile, gross turnover rental is recognized as income in the accounting period on a receipt basis.

A14 DEFERRED INCOME (FRS 139: Financial Instruments: Recognition and Measurement)

Deferred income relates to the difference between consideration received for tenancy deposits and its fair value using the discounted cash flow method.

| Net present value at discounted cash flow |

20,349,972 |

| Deferred income (FRS 139) |

1,058,904 |

| Gross tenancy deposits received |

21,408,876 |

The deferred income will be unwind and recognised as income in the income statement over the lease term.

Review of performance

Actual revenue was higher than the preceding year’s corresponding period by 2.6%. This is due to overall improvement in rentals and car park income in 2010. In addition, the application of FRS117 commencing 1 January 2010 also contributed to the higher revenue in 2010.

What are the new accounting policies or treatment noted?

The QR disclosed that the application of FRS 117 commencing 1 Jan 2010 has resulted in additional revenue of RM1,059,693, may due to the effect of difference on rental income receivable under tenancy agreements which is recognised on a straight-line basis over the term of lease, against the gross turnover rental recognised on a receipt basis.

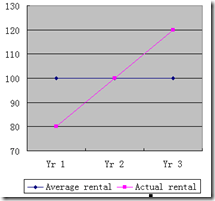

What is this about? It is more likely this is the effect of recognition of rental income which is chargable to tenants on a step-up basis over the lease term or there might be rent free period given at the initial lease term.

Why the effect only shown up in 2010 under FRS 117? Are amendments to FRS 117 which take effect from 1 Jan 2010 affect the recognition of rental income? Take a look at the MASB Amendments to FRS 117. In fact, no amendments were made as to the recognition of rental income.

In order to promote greater compliance to the approved accounting standards, Hektar REIT may take the opportunity under FRS 117 amendments to recognise the rental straight-line effect this year as revenue and trade receivables.

Is this change constitutes a change in accounting policy which may require retrospective application? It may not be the case. It may just a change in presentation and disclosure. Or no retrospective application is necessary may due to its immaterial effect.

|

After |

Before |

|

| Market value of investment properties, say |

10,000,000 |

10,000,000 |

| (already take into consideration of rent free period and step up rental) | ||

| Less: effect of straight-line rental income recognised as trade receivable |

(1,059,693) |

– |

| Fair value of investment properties carried in the book |

8,940,307 |

10,000,000 |

|

30.9.2010 |

30.9.2009 |

|

| Investment Properties |

715,972,878 |

720,000,000 |

The reduction in investment properties may have been effected the amount of trade receivables as a separate current asset item.