Further to our blog on “How to determine Realised / Unrealised Profits?”, there are some new developments in the accounting profession and regulator’s directives.

Revised Bursa Malaysia Directive dated 20 December 2010

In the Bursa Malaysia Directive (Revised) on Disclosure of Realised and Unrealised Profits or Losses, a listed company must disclose the breakdown of unappropriated profits or losses as at the financial year end and the previous financial year, on a company and group basis, into realised and unrealised profits or losses, in the Notes to the audited Financial Statements (instead of the Annual Report as required in the original directive dated 25 March 2010).

The revised directive issued upon the issuance of the Guidance on Determination of Realised and Unrealised Profits or Losses by the Malaysia Institute of Accountants (MIA).

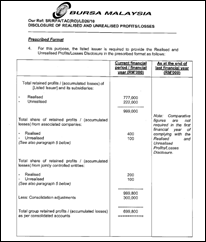

In the Revised Directive, Bursa Malaysia further prescribes the disclosure format in relation to the breakdown of realised and unrealised profits or losses as follows:-

By specifically requires the disclosure to be included in the Notes to the Audited Financial Statements, it is clear that it is the expectation of the regulators to have the disclosure to be audited, if not, at least some form of assurance being provided by the external auditors. This revised directive has created some public outcry by the accounting profession as the breakdown of realised and unrealised profits or losses is not a requirement neither by the accounting standards nor the Companies Act in Malaysia. And often that distinguishing realised and unrealised profit always, to certain extent, quite ambiguous and judgmental.

MIA issues guidance to accountants in response to the Revised Directive

In the MIA’s Circular to its accountants, the applicable financial reporting framework in Malaysia do not deal with the distinction of profits and losses into realised and unrealised, nor do they require the disclosure of such distinction. Accordingly, the Bursa Malaysia Disclosure is construed as supplementary information that is not required by the applicable financial reporting framework to be disclosed in the financial statements.

The auditor may report whether the supplementary information is prepared, in all material respects, in accordance with the MIA Guidance and the directive of Bursa Malaysia Securities Berhad. The auditor shall not include a statement, whether explicitly or implicitly, that the Bursa Malaysia Disclosure achieves a true and fair presentation in the context of general purpose financial statements.

As a guide, the auditors may consider using the following wording in the auditors report:

Other Reporting Responsibilities

The supplementary information set out in Note XX is disclosed to meet the requirement of Bursa Malaysia Securities Berhad and is not part of the financial statements. The directors are responsible for the preparation of the supplementary information in accordance with Guidance on Special Matter No. 1, Determination of Realised and Unrealised Profits or Losses in the Context of Disclosure Pursuant to Bursa Malaysia Securities Berhad Listing Requirements, as issued by the Malaysian Institute of Accountants (“MIA Guidance”) and the directive of Bursa Malaysia Securities Berhad. In our opinion, the supplementary information is prepared, in all material respects, in accordance with the MIA Guidance and the directive of Bursa Malaysia Securities Berhad.

(…..is not part of the financial statements…. — some readers may be confused by this suggested wording. This refers to the supplementary information is not part of the requirements of accounting standards to be disclosed in the financial statements, but yet it is disclosed as required by Bursa Malaysia Directive.)

Since the disclosure is not required by the Malaysian accounting standards, but yet still included in the notes to the audited financial statements. As such, it is constructed as a “Supplementary Information” and as required by the auditing standards, this supplementary information should be clearly distinguished in the audited financial statements. You may notice that in most of the audited financial statements of Bursa Malaysia listed companies , this supplementary information is disclosed (isolately) at the last page of the financial statements and labelled as Supplementary Information (in some cases).

Directors Statement – Section 169(15) of Companies Act

It is required that the Directors to give an opinion whether the financial statements are drawn up in accordance with Financial Reporting Standards (FRS) and the Companies Act, 1965 in Malaysia so as to give a true and fair view.

Since the Bursa Malaysia disclosure is not required by FRS and Companies Act, thus additional paragraph in the statement by directors (in the directors report) may be necessary as the basis of preparation of the disclosure is based on the MIA Guidance instead of FRS or Companies Act.

Here is the typical additional paragraph in the statement by directors:

In the opinion of the Directors, the information set out in Note XX to the financial statements has been prepared in accordance with the Guidance on Special Matter No.1, Determination of Realised and Unrealised Profits or Losses in the Context of Disclosures Pursuant to Bursa Malaysia Securities Berhad Listing Requirements, issued by the Malaysian Institute of Accountants, and presented based on the format prescribed by Bursa Malaysia Securities Berhad.