Malaysia Tax Budget

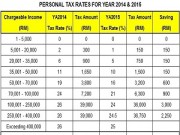

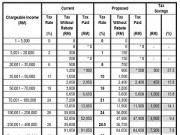

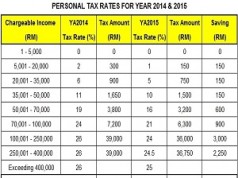

Budget 2015: New Personal Tax Rates for Individuals (YA2015)

As it was announced in Budget 2014 & proposed in the latest Budget 2015, individuals income tax rates will be reduced by 1% to 3% with...

My First Home Scheme – Skim Rumah Pertamaku

Skim Rumah Pertamaku (SRP) - My First Home Scheme was first announced in the 2011 Budget by the Malaysian Government to assist young adults...

Tax Budget 2012: My First Home Scheme (MFH)

Budget 2012 has proposed to increase the maximum price ceiling for houses under My First Home (MFH) scheme to increase from RM220,000 to RM400,000.

This...

Budget 2013: BR1M v2.0 RM500 for Households RM250 for Singles

The 1Malaysia People's Aid (BR1M) will be distributed for the second time and this has been announced that a payment of RM500 (instead of...

Budget Malaysia 2014: Highlights, Tax Summary and Proposals

Budget 2014: Strengthening Economic Resilience, Accelerating Transformation And Fulfilling Promises

Budget 2014 Malaysia was tabled by Prime Minister Datuk Seri Najib Razak in Parliament on...

Malaysia Individual Personal Tax Relief for YA 2010 & YA2011 (both years are same)

Individual personal tax relief is only available for individuals who are considered tax resident in Malaysia. No tax relief is available for non-tax residents....

Budget 2016 Malaysia: Full speech

THE BUDGET 2016 SPEECH BY PRIME MINISTER AND FINANCE MINISTER DATUK SERI NAJIB TUN RAZAK - INTRODUCING THE SUPPLY BILL (2016) AT THE DEWAN...

FAQ: 20% discount on PTPTN loan settlement

In Budget 2013, in order to encourage the students to early repay the PTPTN loan, Prime Minister announced a discount of 20% will be...

Tax Budget 2012: Higher EPF Contribution from Employers

Budget 2012 has proposed that all employers are required to increase their EPF contribution from 12% to 13% for staff who are earning less than...

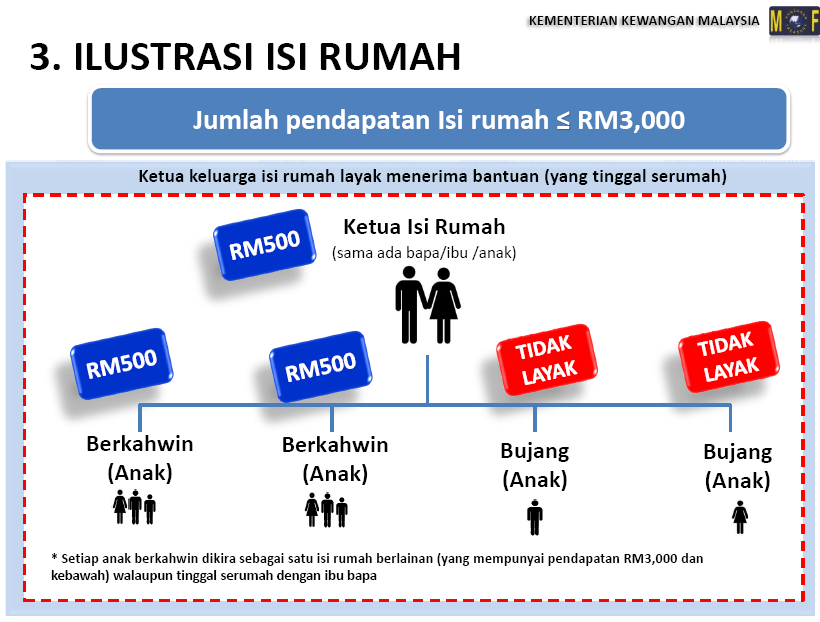

MOF issues FAQ on RM500 cash aid (download registration form here)

Malaysia Ministry of Finance (MOF) open up a toll-free hotline 1-800-222-500 to answer enquiries and provide clarification in relation to RM500 cash aid for...