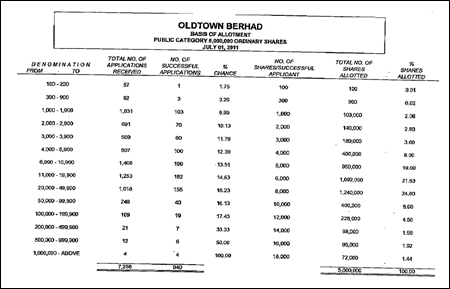

Malaysian Issuing House (MIH) announced that OLDTOWN Berhad 10 million new IPO shares available for Malaysian public were oversubscribed at a rate of 10.76 times. A total of 9,366 applications for 117.6 million shares were received from Malaysian public for a total of 10 million shares available for public subscription. Balloting of successful applications was carried out by MIH today .

Half of the Malaysian public portion or 5 million shares set aside for Bumiputera category. In addition, 2.35 million shares initially set aside for the Bumiputera investors approved by MITI were made available to the Bumiputera public. In total, Bumipuera portion was oversubscribed by 3.64 times with 23.2 million shares applications received under Bumiputera category. Another 50% or 5 million shares for non-bumiputera public category has been oversubscribed by 17.89 times with 94.5 million shares applications received under this non-bumiputera public category.

IPO results and balloting table

Here is the IPO results for balloting of successful applications by Malaysian bumiputera and non-bumiputera public categories published by MIH:

Click here to view balloting and basis of allocation table

Check your IPO application status and results

You may check whether your IPO application is successful or not using your IC number or company registration number at MIH website. Hopefully MIH will be quick enough putting up the list of successful/unsuccessful applicants in their website.

Check IPO application status & results http://mih.com.my/enquiry.php

Alternatively, if you are applied online through internet banking, you may check through your eIPO or eShare status.

Reminder for important dates

Allotment of shares to successful applicants – 8 July 2011 (Fri)

Listing date – 13 July 2011 (Wed)

Wish you luck on the listing day. Cheers!!!