Since the Bank Negara Malaysia imposes the ruling on the maximum loan-to-value (LTV) ratio of 70% cap with effect from 3 November 2010, it is expected there are many house purchasers affected by this ruling.

Some purchasers may persuade the sellers to agree to an inflated selling price in the sale and purchase agreement in order to secure higher loan amount from the banks. The set back to this could be higher stamp duty marginally.

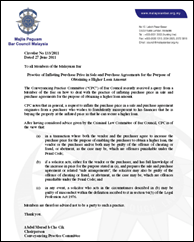

In a member circular issued by Malaysian Bar on 27 June 2011, it stated the purchaser is considered fraudulently misrepresent the banks that he is buying the property at the inflated price so that he can secure a higher loan.

The Malaysia Bar also states that both the purchaser and vendor (seller) may be guilty of the offence of cheating or fraud which are punishable under the law.

The lawyer who acts on the sale and purchase agreement knowingly it is an inflated selling price may also be guilty of offence of cheating or fraud and will also subject to disciplinary action by the Malaysian Bar.

Malaysia Bar advises its members not to be a party to such a practice.