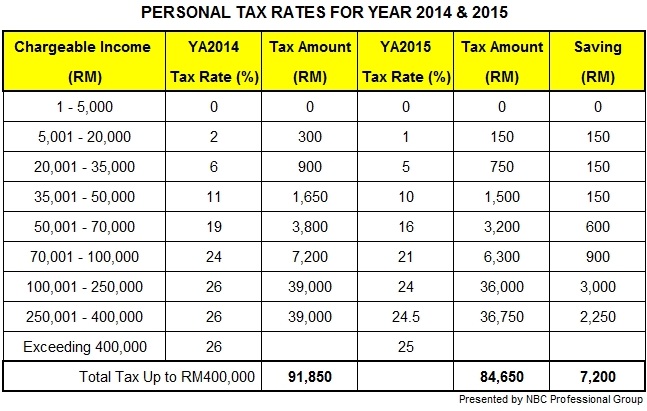

As it was announced in Budget 2014 & proposed in the latest Budget 2015, individuals income tax rates will be reduced by 1% to 3% with effective from the year of assessment 2015.

Technically, families with total monthly income of RM4,000 or less will no longer need to pay any persona tax. Meanwhile, other higher income earners will enjoy bigger saving in tax due to the reduction in tax rates.

Please find the Latest Personal Tax Rates & Table below for details.

To ensure a more progressive tax structure, the chargeable income subject to the maximum rate will be increased from exceeding RM100,000 to exceeding RM400,000. The current maximum tax rate at 26% will be reduced to 24%, 24.5% and 25%.

Hi Angelina,

Based on the new PCB table for year 2015, may I know :

1) IRB requires all employers to comply with “MTD as final tax” (I am not sure of the term that is used by IRB), would this effect the company partly or overall? If yes, please state.

2) How the changes would effect PCB deduction and BIK deduction for expatriates?

3) May I deduct the monthly tax (PCB) base on gross salary and exclude BIK?

4) What are the advantages and disadvantages if the employer chooses to use PCB calculator on IRB website?

Look forward to your reply.

Thank you.