FAQs – New Company Registration (Sdn Bhd ) in Malaysia

If you are going to register your first ever company in Malaysia, the following FAQs may help you to decide what you should do next: Sdn Bhd or Enterprise?

If you are going to register your first ever company in Malaysia, the following FAQs may help you to decide what you should do next: Sdn Bhd or Enterprise?

It is very important to understand what are the benefits & costs of having Sdn Bhd and Enterprise, before making your decision.

If you are any one of the following, Sdn Bhd will be the ideal entity for your business:

1. Estimated yearly sales of more than RM300,000

2. Estimated yearly profit of more than RM100,000

3. Estimated initial capital of more than RM200,000

4. Tender to Government or Petronas Project

5. Plan to apply banking facilities of more than RM1million

To see the differences between Sdn Bhd and Sole-Proprietor/Partnership, see: Pros & Cons of Sdn Bhd, Sole-Proprietor & Partnership

If you are NOT going to achieve any one of the following, Sole-Proprietor or Partnership will be the ideal entity for your business:

1. Estimated yearly sales of more than RM300,000

2. Estimated yearly profit of more than RM100,000

3. Estimated initial capital of more than RM200,000

To see the differences between Sdn Bhd and Sole-Proprietor/Partnership, see: Pros & Cons of Sdn Bhd, Sole-Proprietor & Partnership

In order to register new sdn bhd company in Malaysia, you must engage a company secretary to go through the whole company registration process.

All sdn bhd companies will be incorporated with the Companies Commission of Malaysia (Suruhanjaya Syarikat Malaysia or SSM in Malaysia), SSM Malaysia is a statutory body which regulates companies and businesses.

For more details, see: Register sdn bhd company in Malaysia

No, Suruhanjaya Syarikat Malaysia or SSM Malaysia will not entertain any request to register sdn bhd company directly with them.

Currently, all companies can only be incorporated via SSM MyCoID system (www.ssm-mycoid.com.my) and this program is only open to registered company secretary.

Also, you need to appoint a company secretary to the Board as required by the Companies Act 1965.

As such, you will need to engage services from a secretarial firm to register your new sdn bhd company.

For more details, see: Register new sdn bhd company in Malaysia

In order to register new company in Malaysia, the following are needed:

1. Proposed company’s name

2. At least 2 local directors

3. Cost of company registration of RM2,400-RM3,000

For more details, see: Register sdn bhd company in Malaysia

1. Proposed name of the New Company

2. Business activities of the New Company (max 3)

3. Photocopy I/C (Malaysian) or Passport (Foreigner) of all directors & shareholders.

4. Residential addresses of all directors & shareholders, if these are different from I/C.

5. Information of Paid-up capital of the Company (Min. RM2 & Max RM2,500)

6. Share structure of the New Company (percentage of shareholding by each shareholders)

For more details, see: Company registration in Malaysia

The whole company registration process will take about 8 to 11 working days, please refer time table below for more details:

| No | Events | Days |

| 1 | Company name search with SSM Malaysia | 1-2 |

| 2 | Once name approved by SSM , we will prepare full set of registration documents | 1 |

| 3 | Signing of documents by all directors & shareholders in NBC office | 1 |

| 4 | Stamping of M&A by LHDN and Submission to SSM | 3-6 |

| 5 | Issuance of Digital Incorporation Certificate by SSM | 1 |

| 6 | Submission of First form (Form 24, 44 & 49) | 1 |

| Total minimum working days required | 8-12 |

Note: The above timetable is merely estimated based on NBC’s past experiences dealing with SSM and it is largely subject to any delay from SSM and availability & stability of SSM’s MyCoID online system.

For more details, see: Company registration in Malaysia

Yes, all new companies can open bank account with any bank in Malaysia, subject to respective bank’s policies & requirements.

However, there are a lot of changes in banks’ policies for opening bank account recently, we strongly advise you to visit any bank to clarify with the relevant bank officers & ensure you are fully aware & ready with the exact requirements from the bank.

Please take note that a foreigner without working permit/business visa OR Malaysian who has been blacklisted by Bank Negara will have difficulty in opening/operating company’s bank account.

We do not hold any responsibility if the Company registered by NBC is unable to open bank account due to whatsoever reasons.

For more details, See: How to open bank account in Malaysia?

The directors need to deposit the same amount of money into the Company’s bank account before a company can increase its paid-up capital.

We will not entertain any request from the company to increase the paid-up capital without the “bank-in slip”/“bank deposit slip” from the directors.

For more details, See: Why increase paid up capital need bank-in slip?

A company should budget at least RM5,500 every year to spent on professional charges (audit, tax, secretary & accounting) in order to comply with all statutory requirements (LHDN & SSM).

For more details, See: Yearly charges to maintain a sdn bhd company in Malaysia

You need to apply with SSM for the use of desired company’s name in your new company.

An approved company name will be reserved by SSM for a period of 3 months and registration must be completed within the time frame.

Should you fail to register your new company within the 3 months period due to your failure to execute/sign the registration documents OR make the full balance payment to NBC after signing, we shall assume you have aborted the registration.

For more details, See: Company name search with SSM

In order to be company secretary, the following must be fulfilled:

1. Full age (18 years old)

2. Principal or only place of residence in Malaysia

3. A member of a professional body approved by the Ministry, or a licensed secretary granted by the SSM Malaysia (Companies Commission of Malaysia, CCM) pursuant to section 139 of the Companies Act.

For more details, see: Who can be company secretary?

Any person who want to be a company director must fulfill the following conditions:

1. Full age (18 years old)

2. He is not an undischarged bankrupt;

3. He has not been convicted whether within or without Malaysia of any offence;

4. He has not been imprisoned for any offence within the period of five years immediately preceding the date of his appointment;

5. He consents to act as Director.

For more details, see: Who can be director?

Every company must have its registered office situated in Malaysia. (Section 119 of the Companies Act 1965)

It is general practice in Malaysia that the registered office is located at the Company Secretary’s office in order to fulfill the requirement of Section 139(3).

For more details, see: What is registered office (registered address) in Malaysia?

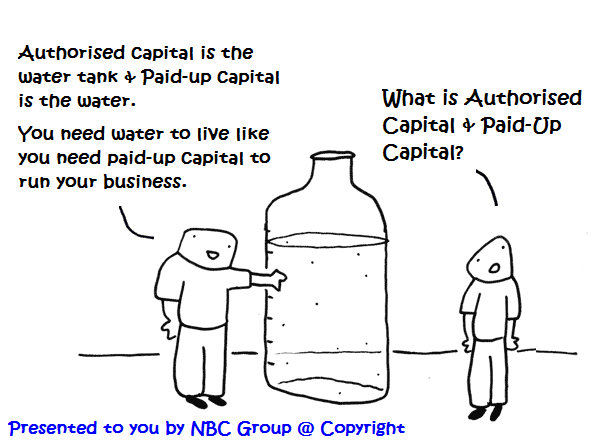

You need to pay minimum filing fee of RM1,000 to SSM when registering new sdn bhd company. The filing fee is actually paid for the registration of RM400,000 authorised capital.

All banks & government departments will look at the level of paid-up capital and ignore the amount of authorised capital registered in a company .

For more details, see: What is Authorised Capital in a Sdn Bhd Company?

We are licensed company secretary and we do not provide services in getting the business/working visa for the directors. The directors are to apply directly with the Immigration Department for relevant visa.

We, as your company secretary, will assist the Company to provide all secretarial documents as requested by the relevant authorities to support the applications.

We do not hold any responsibility if the Company is unable to apply any professional visa / working permit from the Malaysian Government for the directors or its staff.

For more details, See: Foreigner cannot apply business visa under new company