How To Start GST? Get Your Company Ready with GST

In order to start GST, you must first know whether your company is required to be licensed under GST.

If you are ONE of the following categories, you will need not to apply GST license with Royal Malaysia Customs.

- Your company’s last 12 months’ sales was less than RM500,000

- Your company’s next 12 months’ sales is expected to be less than RM500,000

- You are running business in Exempt Supply category

- You are exporting all your products oversea (Out-of Scope)

If you are not anyone of the above, you are required to register with Royal Malaysia Customs (RMC) and charge 6% GST to all your customers.

Zero-Rated Supply Company

If you are running business in Zero-Rated Supply category, you do not need to charge 6% GST even though your company’s yearly sales exceeds RM500,000.

Your company will still need to register with Customs Department in order to claim back GST paid on the purchases & expenses.

For more details, please visit: Claim GST refund from Customs Office

Checklist To Start GST

After knowing you are qualified to charge GST, you must start to do the following:

- Register with Royal Customs Malaysia

- Find good GST-Ready Accounting Software

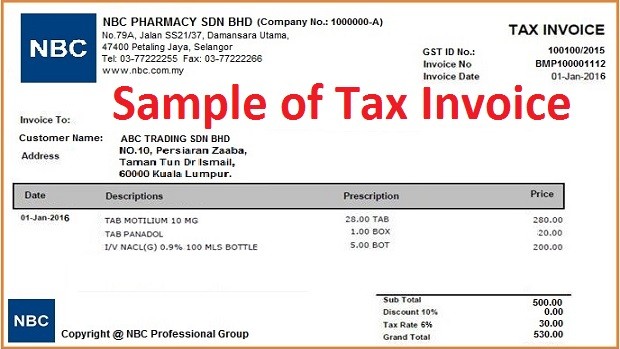

- Issue tax invoice to your customers

- Make sure your suppliers issue tax invoices TIMELY (21 Days Rule)

- Make sure your suppliers’ tax invoices are legally valid & 100% correct

- Keep all accounting records & books up-to-date

- Fill up & submit GST Return CORRECTLY (no mistake allowed)

- Pay GST to Customs (even you have not collected from your customers)

Basic Understanding on GST

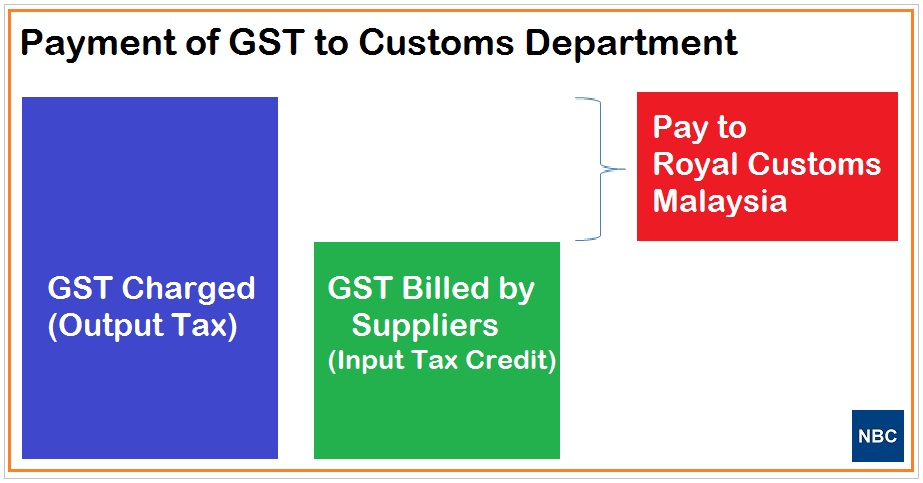

- Your company do not need to pay GST from your own pocket

- Your company is collecting GST from your customers (Output Tax)

- You can claim back the GST you paid for your expenses or purchases (Input Tax Credit)

- Some GST paid by you can’t claim back (Blocked Input Tax Credit)

- You pay the difference only to Customs

Important To Know About Collecting & Paying GST

You will need to pay GST even you have not collected GST from your customer!

Once tax invoice has been issued to your customer, you will need to pay the GST charged to Customs Office regardless whether you have collected the GST or not.

According to the GST 6 months rule, you can claim for refund of GST from Customs Office if your customer has yet to settle the outstanding after 6 months from the date of tax invoice.

However, you may be asked to substantiate the claim (GST refund) by giving an evidence that statements has been issued to the customer periodically & efforts have been taken by your company to recover the debts from the customer.

What Can You Do As A Consumer?

As a consumer, you can’t do anything but to pay GST to the merchants whenever you see your bill come with GST Amount. You may choose to go to those merchants without charging GST.

But beware of higher price for products sold by those merchants.

Check out: You will pay GST for everything anyway

What is NOT a Supply in GST?

What is NOT a Supply in GST?  What is Input Tax Credit in GST? How to get GST Refund?

What is Input Tax Credit in GST? How to get GST Refund?  What is Consideration in GST?

What is Consideration in GST?  What is 6 Months Rule in GST?

What is 6 Months Rule in GST?  Who Can Not Claim Input Tax Credit in GST?

Who Can Not Claim Input Tax Credit in GST?  What is Tax Invoice? How to issue Tax Invoice?

What is Tax Invoice? How to issue Tax Invoice?  Basic Concepts of GST (Goods & Services Tax)

Basic Concepts of GST (Goods & Services Tax)  Basic Concepts of GST (Goods & Services Tax)

Basic Concepts of GST (Goods & Services Tax)