Enforcement key to GST implementation

NewStraitTimes (12/11/2014): The Goods and Services Tax will come into effect in fewer than five months, and as mentioned, strong enforcement is the key to its implementation. The Perak Consumer Movement (PCM) is optimistic that a new tax regime will pave the way for a more sustainable economic growth, albeit in the longer term.

The short- to medium-term post-April 2015 calls for accountability and transparency at all levels to ensure the execution of the GST.

PCM is hopeful that the government’s significant allocation for GST monitoring and enforcement efforts in the 2015 Budget will mitigate the probability of adverse risks resulting from profiteering.

This includes empowering the Price Monitoring Unit as well as establishing on-the-ground squads comprising consumers, village heads and consumer groups to monitor price hikes, entrusting enforcement agencies to investigate and, if necessary, prosecute offenders.

Needless to say, these are commendable efforts, only if responsibly rolled out.

While PCM supports the GST, the looming concern stands. Government agencies must address the likely inflationary consequences that would impact consumers, and, largely, Malaysia’s growth.

In general, the government anticipates the GST to lower costs of at least 50 per cent of products as compared with the current Sales and Services Tax regime.

However, this will become a reality only if suppliers act dutifully, by passing on cost savings to consumers.

Source & More News at New Straits Times Online

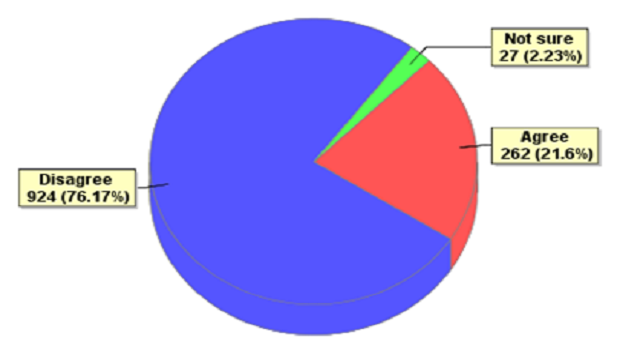

Do you agree that GST should be implemented in Malaysia?

Do you agree that GST should be implemented in Malaysia?  Parliament: GST Bill passed in Dewan Rakyat

Parliament: GST Bill passed in Dewan Rakyat  Rafidah: More Simplified GST Information, Not Billboard!

Rafidah: More Simplified GST Information, Not Billboard!  Advertising Cheap Sales Before GST Prohibited

Advertising Cheap Sales Before GST Prohibited  PM: RM1,000 Subsidy For GST Accounting Software

PM: RM1,000 Subsidy For GST Accounting Software  Goods & Services Tax (GST) Is Now Law in Malaysia

Goods & Services Tax (GST) Is Now Law in Malaysia  KPMG: Malaysians may need 2 years to adapt GST

KPMG: Malaysians may need 2 years to adapt GST  Condo, Apartment & Flat Residents: You Have to Pay GST for Maintenance Fees

Condo, Apartment & Flat Residents: You Have to Pay GST for Maintenance Fees