Basic Concepts of GST (Goods & Services Tax)

Goods and Services Tax (GST) is a broad-based consumption tax levied on the import of goods and services, as well as nearly all supplies of goods and services in Malaysia, except for zero-rated & exempt supplies.

In some countries, GST is known as the Value Added Tax (VAT).

What does GST mean for a Malaysia company?

It means that if you are GST registered, you are required to collect GST tax from your customers for the goods and services rendered by you and then pay the tax collected (or not yet collected) to tax authorities.

For example, if you charged RM100 for your services to a customer in Malaysia, you must invoice your customer RM106 (RM100 for your service plus 6% GST tax).

This GST amount invoiced collected on behalf of the tax authorities from the customer must subsequently be remitted to Royal Malaysian Customs Department (RMC) on a quarterly or monthly basis via GST tax filing.

Is my company required to register for GST?

GST is a self-assessed tax and businesses are required to continually assess the need to be registered for GST. GST registration falls into two categories: compulsory registration and voluntary registration.

Compulsory registration

Registering for GST is compulsory when the turnover of your business is more than RM500,000 for the past 12 months – known as the retrospective basis OR you are currently making sales and you can reasonably expect the turnover of your business to exceed RM500,000 for the next 12 months – known as the prospective basis.

Please note that failing to register will attract penalties. There are anti-avoidance provisions to ensure that entities are not established merely to keep turnovers less than the threshold and thereby avoid registration.

Voluntary registration

You may apply to voluntarily register for GST if you are not liable to compulsorily register and you satisfy the following conditions:

- Your annual turnover is not more than RM500,000;

- You only supply goods outside Malaysia (out-of-scope supplies);

- You make zero-rated supplies.

The advantage of voluntary registration is that you can enjoy the benefits of claiming input tax incurred in the course of your business. This is especially so when you make purely zero-rated supplies.

Please note, once you are voluntarily registered, you must remain registered for at least two years and you have to maintain all your records for at least seven (7) years, even after your business has ceased and you have deregistered from GST. You may also have to comply with any additional conditions that are imposed by the Royal Malaysian Customs Department.

Is a Malaysia company required to collect GST tax?

No. Your company is required to register for GST and collect GST only if its annual turnover exceeds RM500,000.

When paying GST tax collected from customers, can the Malaysia company offset the GST tax charged by its suppliers?

Yes. The GST charged by a company to its customers is known as output tax whereas GST paid by the company to its suppliers is called input tax. What you pay to (or claim back from) the Customs Department is difference between your output and input tax.

If a Malaysia company is not GST registered, can it collect GST tax?

No. Goods and Services Tax in Malaysia can only be collected by GST registered entities.

Must a Malaysia company collect GST when exporting goods or services out of Malaysia?

No. Export goods and services are called zero-rated supplies and GST is not applicable.

If a company is not required to register, is it beneficial to register for GST?

It depends. If you are required to register for GST, you have no choice. Otherwise however, you should consider the following pros and cons of GST registration:

Benefits

To the government:

- It generates a stable and predictable tax income in both good and weak economic environment.

- It is an efficient tax due to the comparatively lower cost of administration and collection.

- It allows the Government to lower corporate and personal income taxes, which in turn encourages more foreign direct investment. This leads to overall economic growth.

To businesses and individuals:

- Most large, established businesses are GST registered – getting your business GST registered is often a signal to customers that your business is an established business and has certain size.

- GST is a fairer tax system. It taxes the self-employed and wage earners only when they spend their money.

- GST taxes apply only on consumption. Savings and investment are not taxed. This will encourage people to save and invest in productive activities.

- Cost of doing business is reduced, thereby contributing to lower prices. Businesses do not suffer a tax cost due to the multi-stage credit mechanism since the real taxpayer is the end-user.

Drawbacks

- The disadvantage of GST registration is the administrative burden that comes with discharging the duties and responsibilities of GST registration.

- One must either study the intricacies of GST or pay an accountant to undertake this work which in some cases can be a reasonably high cost.

- Being GST registered effectively increases your selling price by 7%. Your customers who are not GST registered would not be able to recover the GST you charge. So although your costs are reduced because you can recover GST, your customers might not be too pleased.

- GST can be a burden to lower income groups, especially during times of high inflation when the 7% tax is paid on the increasing price of daily essentials.

What is Deemed Supply in GST?

What is Deemed Supply in GST?  What is 6 Months Rule in GST?

What is 6 Months Rule in GST?  Basic Concepts of GST (Goods & Services Tax)

Basic Concepts of GST (Goods & Services Tax)  What are Goods and Services in GST?

What are Goods and Services in GST?  What is Supply in GST?

What is Supply in GST?  What is NOT a Supply in GST?

What is NOT a Supply in GST?  What is Blocked Input Tax Credit in GST?

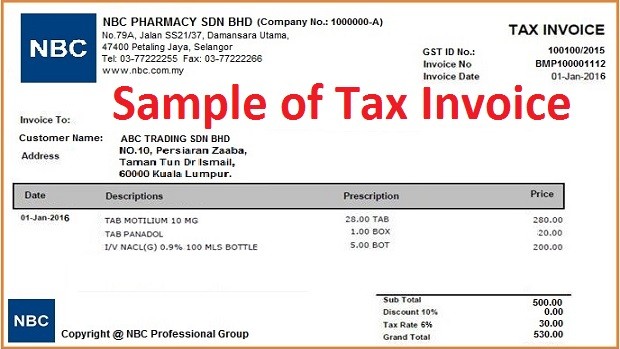

What is Blocked Input Tax Credit in GST?  What is Tax Invoice? How to issue Tax Invoice?

What is Tax Invoice? How to issue Tax Invoice?