The most commonly asked question by our clients in filling up the Form CP204 is: How to calculate tax estimate for CP204?

The most commonly asked question by our clients in filling up the Form CP204 is: How to calculate tax estimate for CP204?

In order to calculate the possible tax payable for the coming year, the company must made several assumptions and projections based on the current year’s management results. It is important to predict what will happen based on what is having now.

Therefore, keeping an up-to-date management accounts will be the key factor in getting more accurate estimation. Making estimation based on personal feeling or baseless information will always result in wrong estimation, worse still, penalty charged by LHDN for under-estimation of tax payable!

The directors of the company must estimate the tax payable for the coming year at their best efforts and the estimated tax should be as close as the actual one that submitted then (Form C).

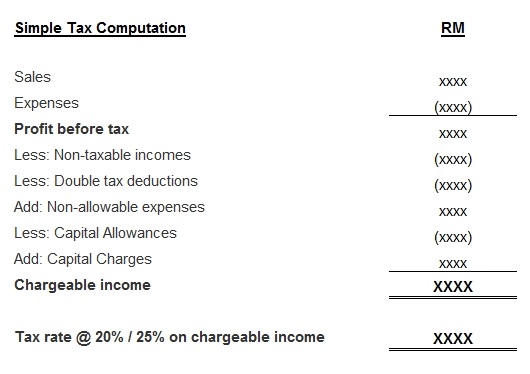

The basis of calculating chargeable income and tax estimate are as follows:

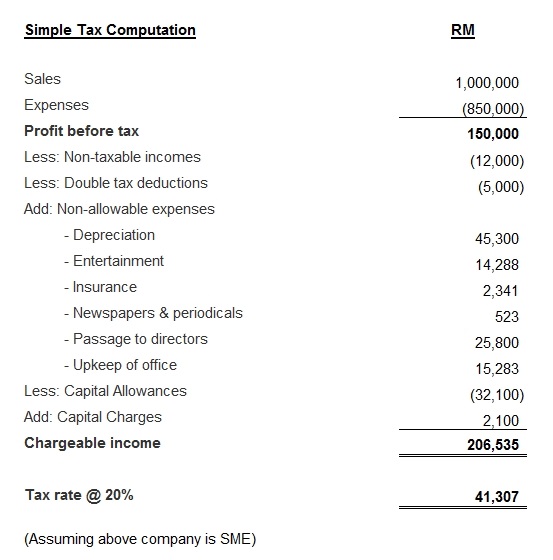

We illustrate the following sample for your easier understanding on arriving the tax estimation for CP204:

Notes from NBC:

We shall advise the above sample company to submit the Form CP204 with the estimated tax payable of RM41,000 to LHDN.

We shall also strongly advise all companies to seek assistance from Licensed Tax Agent / Firm in the submission of CP204 to LHDN within the stipulated period to avoid any unnecessary late or incorrect Form CP204 submitted or under/over estimation of tax payable.

Services offered by NBC Tax:

- Tax compliance on filling up Form CP204

- Tax advisory on getting estimated tax payable for CP204