KPMG: Malaysians may need 2 years to adapt GST

TheStar Online (10/5/2014): IT could take up to two years before businesses are able to operate smoothly once the goods and services tax (GST) is implemented.

The time after the introduction of GST is critical as uncertainties and changes made by the Government would most likely arise, making it especially challenging for businesses.

The implementation of GST will prove to be a steep learning curve for most businesses within the country that have no exposure overseas.

“It is a learning experience for businesses and tax authorities,” says KPMG’s leader for Indirect Taxes Centre of Excellence in China Lachlan Wolfers.

For this reason, he adds that it is critical for the Government to provide some leniency to businesses in the initial one to two years after the tax is implemented.

“The implementation of GST in Australia was successful because the Government was trying to encourage the people to do the right thing and voluntarily comply and when you do that, people will naturally take the effort. So, I think having the same leniency is very important,” he says.

For Malaysia, the benefit of coming on board the GST train at this time is that it can learn from the successes and failures from implementation in other countries.

The GST had quite a few false starts in Malaysia, resulting in many taking a wait-and-see stance after the announcement during Budget 2014, especially since the legislation had not been passed until last month.

With just under a year till GST goes live starting April 1, 2015, businesses need to make some serious headway in becoming GST compliant and GST ready.

Businesses, big or small, cannot afford to rest on their laurels. An immense amount of testing and trial runs will have to be conducted, which may take up quite some time.

Businesses have to ensure their accounting software is properly updated with a GST module that enables capturing and computation of the tax, and should also, prior to the effective date, be confident that their systems and processes are in proper working order.

Although some businesses have operations and exposure in other countries that have adopted GST or the value-added tax (VAT), not all GST modules can be implemented as it is, in Malaysia.

There would still be many differences in the GST rules between different countries.

“Therefore, such businesses would still need to deploy a significant amount of time and resources to training and implementing IT systems configuration,” says BDO Malaysia head of tax advisory David Lai.

Many accounting firms have been kept busy with GST seminars, catering to small and medium enterprises, as well as the public, to enhance awareness on the tax that will replace the current sales and service tax.

The Royal Malaysian Customs have also issued guidelines on its practices, procedures and interpretation of the GST legislation. A lot of the groundwork has been done, and assistance.

Lachlan believes Malaysia is slightly further advanced than when Australia was implementing GST.

“In terms of the education process, it is very achievable to implement it within the timeframe.

“Customs has done a lot of ground work, and has starting consulting and conducting seminars with businesses, whereas in Australia, not much of the ground work was done before the legislation there passed,” he says.

Now that the legislation has been passed, industry groups and consultants will be able to expand more broadly on queries, accountants say.

Leading up to the GST implementation in April next year, by the time it is nine months till it goes live, businesses should understand the overall financial impact the tax has on its operations and the key technology issues that needs to be addressed.

Six months to GST, businesses should be focusing on system changes that need to be made, and then three months away, they need to look at pricing changes and communicate with their customers.

KPMG has developed a toolkit to help mainly small and medium enterprises identify the impact of GST.

“The most critical areas they would need to assess are the impacts to the business. The toolkit shows where it impacts most, for example, human resources. With the impact assessment, implementation plans can then be put in place,” says KPMG Malaysia managing director and head of advisory Datuk Hew Lee Lam Sang.

Source: thestar online

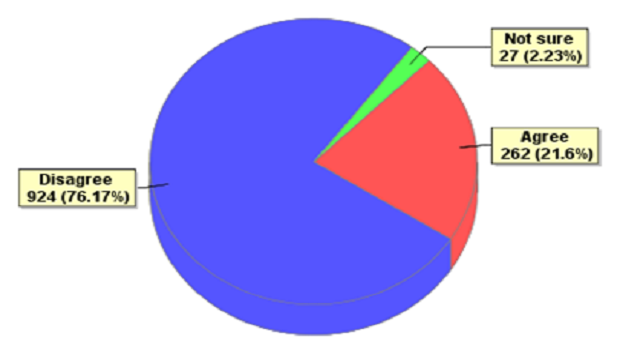

Do you agree that GST should be implemented in Malaysia?

Do you agree that GST should be implemented in Malaysia?  Condo, Apartment & Flat Residents: You Have to Pay GST for Maintenance Fees

Condo, Apartment & Flat Residents: You Have to Pay GST for Maintenance Fees  Goods & Services Tax (GST) Is Now Law in Malaysia

Goods & Services Tax (GST) Is Now Law in Malaysia  Advertising Cheap Sales Before GST Prohibited

Advertising Cheap Sales Before GST Prohibited  Enforcement key to GST implementation

Enforcement key to GST implementation  Rafidah: More Simplified GST Information, Not Billboard!

Rafidah: More Simplified GST Information, Not Billboard!  PM: RM1,000 Subsidy For GST Accounting Software

PM: RM1,000 Subsidy For GST Accounting Software  Parliament: GST Bill passed in Dewan Rakyat

Parliament: GST Bill passed in Dewan Rakyat