What is Exempt Supply in GST?

Exempt Supply means goods and services sold by the companies are free from Goods and Services Tax (GST). No GST will be charged on these goods & services.

For company and business, GST paid on the assets, purchases or expenses for their businesses cannot be claimed as Input Tax Credits. Ultimately, the GST paid will be absorbed by company or busienss as part of their business costs.

In order to maintain the profit margin, these companies will have no choice but to increase the price of their goods or services.

List of Exempt Supply

The following are the businesses or services fall under the list of Exempt Supply:

- Financial Services

- Public Transport Services

- Private Education Services

- Tolled Highways or Bridges

- Childcare Services

- Funeral, Burial and Cremation Services

- Private Healthcare Services

- Supplies Made by Societies

- Residential Land or Building

- Agriculture or General Use Land

Public Transport Services Under Exempt Supply

- Mass public transport by rail (LRT, ERL, MRT, Monorail, etc)

- Ships or Boats

- Ferries

- Express bus

- Workers’ bus

- School bus

- Feeder bus

- Taxi

Land, Building and Lease of Property Under Exempt Supply

- Goods – Land used for residental or agricultural purposes or general use (for example, burial ground, playground or religious building)

- Goods – Building used for residential purposes

- Services – Right to use or license to occupy residential property (land or building or both)

- Services – Right to use or license to occupy land for agricultural purposes or general use (government building, burial ground, schools, playground, parks, etc.)

For full list of Goods & Services that exempted from GST, please download here: P.U. (A) 271 – Goods and Services Tax(Exempt Supplies)

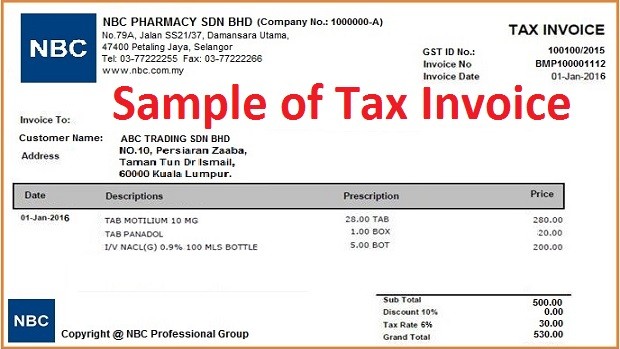

What is Tax Invoice? How to issue Tax Invoice?

What is Tax Invoice? How to issue Tax Invoice?  What are Goods and Services in GST?

What are Goods and Services in GST?  What is Supply in GST?

What is Supply in GST?  What is Blocked Input Tax Credit in GST?

What is Blocked Input Tax Credit in GST?  Scope of Goods & Services Tax (GST)

Scope of Goods & Services Tax (GST)  Basic Concepts of GST (Goods & Services Tax)

Basic Concepts of GST (Goods & Services Tax)  What is 6 Months Rule in GST?

What is 6 Months Rule in GST?  What is Deemed Supply in GST?

What is Deemed Supply in GST?

May I know whether that dental charges fall under healthcare services? Exempted for tax? If yes, both the goods (implant…) and service (treatment adn consultation) is free from GST?

Hi Connie, as medical service provider, you do not need to register with Customs & do not need to charge GST on your services to your patients.

However, you won’t be able to claim any GST that paid to your suppliers or merchants arising from purchase of materials or office stuff.

Thank you.

Hello

May I know if the companyb having a land size of above one acre landed property whether an agricultural or industrial is subiect for gst? Sincr companyvis subjectbfor 5% tax irrespective of 5 yrs and above