What is Deemed Supply in GST?

Deemed Supply may apply where no consideration is received for the supply of goods or services.Examples of Deemed Supply are:

- Barter arrangements where goods sold are settled by other goods from customer

- Free gift worth more than RM500 to staff

- Hamper worth more than RM500 to customer

- Free bottles of regularly sold shampoo to customers

Scope of Goods & Services Tax (GST)

Scope of Goods & Services Tax (GST)  What are Goods and Services in GST?

What are Goods and Services in GST?  Basic Concepts of GST (Goods & Services Tax)

Basic Concepts of GST (Goods & Services Tax)  What is 21 Days Rule in GST? (Time Bomb in GST)

What is 21 Days Rule in GST? (Time Bomb in GST)  What is NOT a Supply in GST?

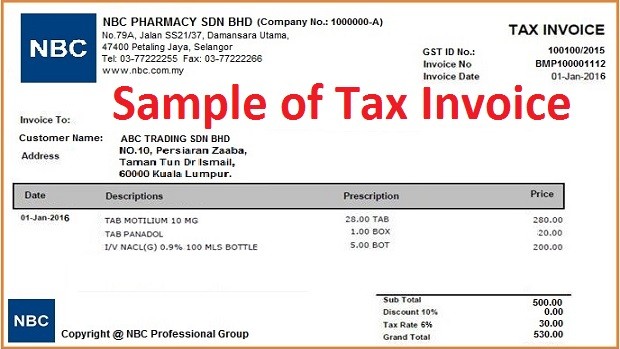

What is NOT a Supply in GST?  What is Tax Invoice? How to issue Tax Invoice?

What is Tax Invoice? How to issue Tax Invoice?  What is Blocked Input Tax Credit in GST?

What is Blocked Input Tax Credit in GST?  Who Can Not Claim Input Tax Credit in GST?

Who Can Not Claim Input Tax Credit in GST?