In an IPO press release issued by Malaysian Issuing House (MIH) dated Nov 12, 2010, Petronas Chemicals Group Berhad (PCG) received a total of 78,613 applications for 636 million shares from the Malaysian Public for a total 160,000,000 shares available for public subscription, which represents an oversubscription of 2.98 times.

Out of 160 million shares, 80 million shares have been set aside for allotment under the Bumiputera category which represents 50% of the shares offered for public subscription while the balance of 80 million shares were allotted under the Public category. A total of 14,319 applications for 124 million shares were received under the Bumiputera category which represents an oversubscription of 0.55 times while under the Public category 64,294 applications for 512 million shares were received which represents an oversubscription of 5.40 times. In view of the oversubscribed situation for shares under the Malaysian Public Bumiputra category, a total of 40,158,600 unallocated shares reserved for eligible Directors and staff of PCG Group and Petronas (including eligible customers and others) were made available to the Malaysian Public Bumiputra category, in addition to existing allocation of 80 million shares to this category.

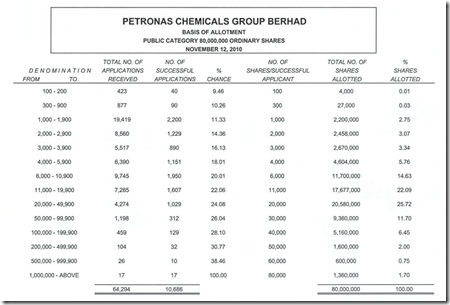

Balloting Table – Basis of Allotment – Public Category

Basis of Allotment – Bumiputra Category

http://mih.com.my/index.php?page=bs502b

MIH Announcement on Basis of Allotment

MIH Press Release Statement to Bursa Malaysia

You may check whether your IPO application is successful or not using your IC number or company registration number at MIH website. Hopefully MIH will be quick enough putting up the list of successful/unsuccessful applicants in their website.

Check IPO application status & results http://mih.com.my/enquiry.php

Alternatively, if you were applied online through internet banking, you may check through your eIPO or eShare status. This method may be more efficient than the MIH website, as the banks will update the IPO application status in your internet banking and refund your application monies within few working days should your application is not successful. This is way more faster and efficient than you buy a bank draft and submit your IPO application form manually.

Update: Applications via all internet banking should have the application status update now. CIMB, Maybank, Affin and RHB Bank. Check your internet banking now for application status.

Status of Application and Refund of Money

- Application via ATM or Internet Banking – MIH will inform banks of the unsuccessful or partially successful application (include successful application) within 2 market days after the balloting date. The application monies or the balance of it will be credited into the bank accounts within 2 market days after the receipt of confirmation from MIH. In total, you may check your bank account on the latest fifth market day, or earlier. If your application is under reserved or waiting list, but subsequently unsuccessful, the banks will refund to you within 10 market days from final ballot date.

- Application via White Application Form – The money will be refunded to you via the self-addressed and stamped Official A envelope you provided by ordinary post (for fully unsuccessful applications) or by registered post to your last address maintained with the Bursa Depository (CDS account address)(for partially successful applications) within 10 market days from the final ballot date.

PCG vs MMHE

Let’s compare how is PCG’s public non-bumi portion performed, compared to Malaysia Marine And Heavy Engineering Berhad (MMHE).

MMHE’s public non-bumi portion was oversubscribed by 12.36 times, representing a total application monies of approx RM 714 million.

16 million shares x RM3.61 per share x 12.36 times = RM714 million

PCG’s public non-bumi portion was oversubscribed by 5.40 times, representing a total application monies of approx RM 2,181 million.

80 million shares x RM5.05 per share x 5.4 times = RM2,181 million

It is noted that PCG has attracted an even stronger interest from the Malaysia public (non-bumi category), may thank to MMHE’s first day listing premium of RM0.71 or 20% jump over its retail price RM3.61.

Congratulation!

Lastly, a BIG congratulation to you who have successfully applied for the IPO shares and looking forward for another strong and big debut premium on the listing day 26 Nov 2010, Friday.

See all posts related to Petronas Chemicals Group IPO

http://www.nbc.com.my/blog/?tag=petronas-chemicals-ipo