A lot of people get confused when they thought that the income tax has already been taken care of by the deduction of PCB from their salaries. They have assumed that taxes have already been paid and no need to pay tax any more.

A lot of people get confused when they thought that the income tax has already been taken care of by the deduction of PCB from their salaries. They have assumed that taxes have already been paid and no need to pay tax any more.

This is WRONG! Totally WRONG!

That’s the main reason why many people only realised that they still owe LHDN tens of thousands tax when they about to retire! (EPF final withdrawal will need to get tax clearance from LHDN, LHDN will demand KWSP to settle the outstanding tax amount before the release of fund to the account holders.)

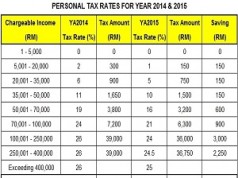

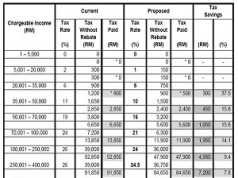

The PCB deduction is normally not enough to cover the actual tax payable by the tax payees, that is you.

Let’s take a look how PCB works and the principle of PCB.

What is PCB?

PCB (Potongan Cukai Berjadual or Monthly Tax Deductions) is an income tax deduction mechanism from employee’s current monthly remuneration (salaries). These deductions are intended to reduce the employee’s burden to pay in one lump sum when the actual tax is ascertained.

How to pay PCB?

It is employer’s responsibilities to deduct the PCB from the remuneration (salaries/wages) of employee that he or she received from the company. The employer (company) shall then remit the sum deducted from the employee to the Inland Revenue Board (IRB or LHDN) not later than the 10th day of the following month.

You still need to pay tax

Since the objective of PCB is to reduce your burden by making monthly tax payment in advance to LHDN, you will still need to compute the income earned and actual tax due for previous year.

Submit your income tax return and pay the balance tax due (total income tax payable minus total PCB paid) before the end of April to avoid any unnecessary late penalty.

Good luck to you!

P.S.: You can request your company to deduct higher PCB from your salary and it is fine to do so.