Malaysia Tax & LHDN (IRB)

Real Estate Investment Trust (REIT) in Malaysia

REIT may consider as good as EPF on its tax exemption status, as all the rental, interest and other investment income earned by REIT are exempted from tax, provided that the REIT distributes at least...

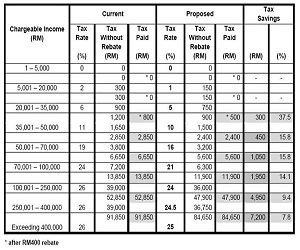

Malaysia Budget 2011 Summary and Highlights

“ 1Malaysia, Generating Transformation ”

Summary & Highlights - Tax Changes & Proposals

Existing EPF relief of maximum RM6,000 is extended to include employees’ contributions to private staff retirement schemes. Employers are allowed for tax deductions for contributions...

Due Day Extended for Personal Tax Submission: 15 May 2013 (E-Filing Only)

Inland Revenue Board (LHDN, Lembaga Hasil Dalam Negeri) has extended the deadline for personal tax return submission and balance of tax payment for employment income to 15 May 2013.

The extension of due date is...

Inland Revenue Board of Malaysia

The Inland Revenue Board of Malaysia (IRBM) is one of the main revenue collecting agencies of the Ministry of Finance.

The Department of Inland Revenue Malaysia became a board on March 1, 1996, and is...

Submit your Form B 2010 tax return by 30 June 2010

In a press release, Inland Revenue Board Malaysia will continue its Taxpayer Service Month Program until 30 June 2011.

The program is focus on taxpayers who are deriving business income submitting their Form B for...

What is Borang E? Every Company Needs To Submit Borang E Now!

Employer Return (Form or Borang E and CP8D) is required to be submitted by every employer (company/enterprise/partnership and etc) to LHDN (Inland Revenue Board, IRB) every year not later than 31 March. (Note: Grace...

Employee Benefits and Income earned by Staff exempted from Income Tax

With effect from YA 2008, employees are given tax exemption on allowances, benefits in kind and perquisites that received from their employer as follows:

(a) perquisites in relation to travel allowance, petrol card, petrol allowance...

Tax Return Form B 2010 and Form P 2010

30 June 2011 tax filing deadline for Tax Return Form B 2010 and Form P in respect of year of assessment 2010 is approaching with less than a month to go.

Form B is tax...

Malaysia Personal Tax – FAQ

Encountered some questions on Malaysia personal tax matters?

Inland Revenue Board (IRB), the Malaysian tax authorities published some FAQ that may be relevant to individual tax payer in Malaysia. Here are some extracts:

Assessment of Tax

Q...

GST: main cause for higher inflation in 2015

Goods and Services Tax (GST) has been very must talk of the town following the announcement of time table for implementing GST in the Budget 2014 by Prime Minister Datuk Seri Najib Razak.

Based on other...