Following the closing of UOA IPO for application on 25 May 2011 and balloting of successful applications on 27 May 2011, what are the next IPOs we can looking forward?

Some UOA IPO applicants may get to know their application status if they were applied through eipocimb.com or cimbclicks.com.my or even ATMs. For those applied manually by paper submission, they may have to wait MIH to upload the IPO application status and results onto its website at http://mih.com.my/enquiry, or will have to wait for post mail on shares allotment notice (if successful) or return of bank draft (if unsuccessful).

UOA IPO listing date 8 June 2011 – exit time!

By 8 June, you will be able to exit your UOA investment by selling it at the market to spare cash for the upcoming exciting IPO (OLDTOWN) and mega IPO (Bumi Armada). It is reported that OLDTOWN IPO price fixed at RM1.25 per share. However, Bumi Armada IPO price remains unknown.

When the IPO prospectus will be launched?

|

Late date of exposure |

Estimated date for IPO launch | |

| OLDTOWN | 17 June 2011 | around 27 June 2011 |

| Bumi Armada | 25 May 2011 | around |

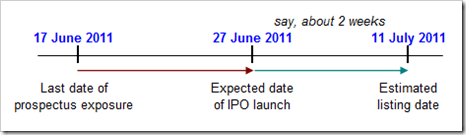

For OldTown listing date, The Star reported that it is tentatively set on 11 July 2011. Counting backward by 2 weeks from listing date to the IPO launch date, the IPO may be launched around 27 June 2011.

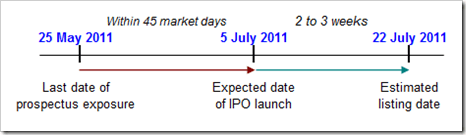

(Updated 2.6.2011) In respect of Bumi Armada, according to a notice of application for bumiputera special shares under IPO published by Ministry of International Trade and Industry (MITI), final offer price will be announced on 12 July 2011. Normally price determination date is one day after the closing of retail offering. Counting backward from 12 July 2011 by 6 market days, the IPO launch date could be around 5 July 2011.

Based on the SC main market submission process timeline, if everything is going smooth, the issuance of IPO prospectus of Bumi Armada is expected to be launched within 45 working/market days from the last date of exposure of draft prospectus.

OLDTOWN – estimated IPO process timeline

Bumi Armada – estimated IPO process timeline (revised)

(Updated 2.6.2011) Looking at the estimated timelines above, OLDTOWN investors may not able to exit from their investment and channel their money into Bumi Armada IPO immediately. Don’t forget T+3 rules will also take up some time for trading clearance.

If the IPO process timelines above are correct, meaning to say, investors can put their capital in OldTown IPO and exit on the listing date around 11 July 2011, then re-invest in Bumi Armada IPO around 26 July 2011. However, the IPO process timeline may not 100% accurate as sometimes mega IPO may be priortised and processed faster. Do not eliminate the possibility that Bumi Armada may be launching their IPO sooner than expected.

It is bad that if one IPO is clash with another and has to compete with another mega IPO like Bumi Armada which will absorb large amount of market liquidity as well as investors capital.

Anyhow, prepare your capital and try your luck in the coming IPOs. Good luck to you all.